Helping You Be Prepared

Log In/Enroll Now

The University offers our eligible faculty and staff members comprehensive benefits. These include medical, dental, vision, and flexible spending accounts, life insurance, long-term disability, a retirement plan with 100% immediate vesting, a workout facility, wellness programs, and tuition benefits.

Prepare for Open Enrollment and make informed benefit decisions for you and your family.

- April - Benefits Educational Series - these information sessions are designed to help you and your family review, learn, and prepare for the benefits fair and open enrollment.

- May - Save the Date - Benefits Fair - In-Person! Wednesday, May 15, 2024 | Power Center Ballroom | 10:00 a.m. - 3:00 p.m.

- Open Enrollment runs Monday, May 13 to Friday, May 24, 2024.

Visit here in April to participate in a number of educational offerings to prepare

you and your family for 2024-2025 Open Enrollment and the May 15th In-Person Benefits

Fair. Duquesne University is committed to a holistic approach in providing benefits that

support faculty and staff well-being. Medical Plans: Dental Plans: Life Insurance: The Benefits Overview Guide will provide detailed coverage and cost information. When considering your benefit options please note that the Healthcare Reform now entitles

children up to age 26 to participate in their parents’ health plan. The children can

be married and do not have to live at home, be full time students, or be claimed on

their parents’ taxes to be eligible for benefits. Eligibility ends on the last day

of the month in which the child turns 26. If you are enrolling your spouse and/or dependent children proper documentation is

required to verify your dependents. When ready to enroll, eligible employees can select or manage their benefit elections

through the Benefits Enrollment Portal at any time. As part of the University's Wellness in Motion program, the Center for Pharmacy Care

offers campus health screenings, lifestyle counseling, educational seminars, drug

therapy review and management, disease state management, and outcome reporting for

certain health conditions. The Center for Pharmacy Care is part of the Duquesne University Pharmacy. It is a

pharmacist-coordinated provider of disease prevention and disease management services

for the Duquesne University campus and Pittsburgh community. Duquesne University is committed to employee financial well-being, offering a retirement

plan that helps employees prepare for and build long-term financial security. The Roth 403(b) is a part of the University's retirement plan and provides eligible

employees with an option to make voluntary contributions on an after-tax basis. What is a 457(b) plan? The University also offers a 457(b) Retirement plan for eligible employees. This plan

is a non-qualified, tax advantaged, deferred compensation retirement plan that is

used to provide an additional opportunity for pre-tax contributions for eligible employees. Department of Labor regulations require the University to provide detailed information

about investment options and expenses associated with these investments.April Benefits Education Programing

Employee Benefits

Duquesne University offers their eligible faculty and staff a high deductible health

plan (HDHP) or a PPO plan with both Highmark and UPMC.

Dental benefits are provided through MetLife. Eligible employees have the option to

enroll in either a basic or enhanced plan.

Vision Plans:

Vision benefits are provided through VSP Vision Care. Eligible employees have the

option to enroll in either a basic or enhanced plan.

The University offers term life insurance and accidental death and dismemberment coverage at no cost to eligible employees. The coverage is equal to one times annual

salary up to a maximum of $300,000.

Employee optional term life insurance provides additional protection for those who depend on you financially. Your need

may vary depending on age, number of dependents, dependent ages, and financial situation.

You are responsible for the cost of the optional coverage you choose.

Spouse and Child optional life insurance also offers financial protection when the unexpected happens. You are responsible

for the cost of this affordable optional coverage.

Disability Insurance:

Long-term disability replaces a portion of your income if illness or accident prevents

you from working for an extended period of time.

Basic long-term disability (LTD) is provided, after a 12-month wait period, at no cost to eligible employees. This

benefit provides 50% of base salary to a maximum benefit of $5,000 per month.

Buy Up Long-Term Disability provides an additional 10% when added to Basic LTD allows up to 60% of base salary

to a maximum of $12,000 per month. Employee is responsible for the cost of this premium.

The EAP benefit offers confidential, free solutions to help you and your family members

navigate the financial, legal, and mental health, job stress, and other life challenges

that affect your well-being.

Learn about the everyday services that the Employee Assistance Program offers, at no cost to you or your eligible family

members.

If it is your first time visiting the site you will need to follow the instructions

and create an account.

Leaves of Absence:

The Family and Medical Leave Act (FMLA) provides eligible employees up to 12 weeks

of unpaid, job-protected leave for certain family and medical reasons (up to 26 weeks

to care for a military service member injured in the line of duty).

Duquesne University also offers a 100% Paid Maternity and Parental Leave of absence for eligible employees. The University's Paid Maternity Leave allows for

four consecutive weeks of 100% paid leave to be used immediately following the birth

of a child. The Paid Parental Leave allows for two consecutive weeks of 100% paid

leave that can be used within 12 months of the birth or placement of a child for adoption,

foster care or legal guardianship.

Employees covered by a collective bargaining agreement should refer to their current

contract.

Duquesne University offers valuable education benefits through their Tuition Remission

and Tuition Exchange Programs.

Eligible employees and their eligible spouses and dependents can take advantage of

Tuition Remission at the basic tuition rate. The first year of employment Tuition

Remission offers a 55% discount on the basic tuition rate, after one year of employment,

the discount increases to 80%, and after two years of employment Tuition Remission

offers a 100% discount on the basic tuition rate.

There are administrative fees associated with this program.

The Tuition Remission Application can be completed upon hire and student is registered for classes.

Tuition Exchange

Duquesne University also participates in the Tuition Exchange and Council of Independent

Colleges Program. These programs are limited to full-time undergraduate studies.

Application for this program generally opens for dependents when they enter their

senior year of high school.

Some of these benefits are based on employment status.Retirement Plan

Duquesne University's Match Contribution

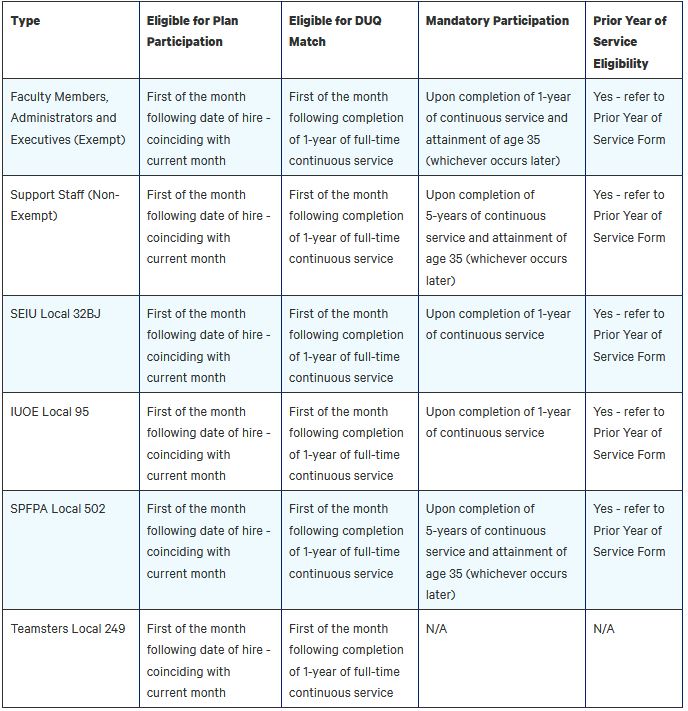

The University offers a match. Eligibility for the match is based on employment status

as outlined in the chart below.

Retirement Eligibility

Log In or Enroll in Retirement Plan

Yes, the Duquesne University plan will accept rollovers from other pre-tax sources.

What is the maximum amount that I can contribute?

Federal tax law limits the amount you can contribute. The limit for calendar year

2023 is $22,500 with an additional $7,500 catch-up for those age 50 and above.

Are the any other voluntary contribution options?

Yes, employees have the ability to contribute their own money to a University sponsored

Roth 403(b) Plan. Eligible employees have he option of electing after-tax contributions

through payroll deductions into the Roth 403(b) voluntary contribution option under

the Duquesne University 403(b) Defined Contribution Retirement Plan.

Are there any loan features associated with the Duquesne University Retirement Plan?

Yes, employees may take a maximum of two loans based on all accumulations.

The salary threshold to participate in this plan must meet the IRS definition of a

highly compensated individual. For 2024 the IRS definition of a highly compensated

individual is $155,000.

For more information about this plan please reach out to the Benefits Office or a

TIAA financial advisor at 800-732-8353.

Qualified Default Investment Alternative (QDIA) Initial Notice

Summary Annual Report

2021 Duquesne University 403(b) Retirement Plan Summary Annual Report

Summary Plan Description

Duquesne University 403(b) Defined Contribution Retirement Plan Summary Plan Description

Universal Availability

Duquesne University 403(b) Retirement Plan Universal Availability

Plan and Investment Notices

TIAA Plan and Investment Notice

Valic Plan and Investment Notice

The disclosure gives plan participants a complete picture of all the funds and associated

expenses available. The disclosure is for informational purposes only.

The information includes: